fundamental risk affects closed end funds in which of the following ways

A closed-end fund serves this clientele. Listed CEFs can offer intra-day liquidity.

4 Questions To Ask Yourself Before Buying Cryptocurrency Nextadvisor With Time

Amended Policy Effective February 2 2021.

. A n ____ sells fund shares either directly to the public or through authorized dealers. A closed-end fund is a fund that offers a set number of shares. Closed-end funds may trade at a discount or premium to their NAV and are subject to the market fluctuations of their underlying investments.

Under normal market conditions the Fund will invest substantially all at least 90 of its. Investment policies management fees and other matters of interest to. Closed-end funds are more likely to invest in income-producing assets than open-end funds but the discount to NAV can rise price falls versus NAV after you buy the shares.

In addition they are allowed to. Closed-end funds may trade at a discount or premium to their NAV and are subject to the market fluctuations of their underlying investments. Supply and demand and other fundamental factors can cause a closed-end mutual fund to trade at a premium or discount to the net asset value per share.

2 Closed-end funds usually trade at substantial discounts relative to their net asset values. Shares of closed-end funds frequently. Irradional noise traders earn high returns for bearing risk that they themselves create.

A n ___ oversees a mutual funds portfolio and makes the buy and sell decisions. Like other ETFs and mutual funds a closed-end fund is made up of a collection of securities and can provide. The term feature ensures NAV liquidity upon maturity.

Fundamental risk affects closed end funds in which of the following ways Monday August 22 2022 Edit Closed-end funds have a fixed capital structure and number of. Closed-end funds and sentiment risk. 1 New funds appear on the market at a premium and move rapidly to a discount.

Diversifying across closed-end funds does little to. PCQ PCK and PZC. To keep matters simple and the results easily comparable with normal studies of returns which are concerned with long positions I will examine how short ratios affect the returns to long.

Shares of closed-end funds frequently. There are also non-listed CEFs with continuous subscriptions and regular. Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund.

The value of the closed end funds shares is an algebraic sum of the assets-under-management plus the capitalized value-added by. A closed-end fund generally is not required to buy its shares back from investors upon request. That is closed-end fund shares generally are not redeemable.

Fundamental risk affects closed end funds in which of the following ways Monday August 22 2022 Edit Closed-end funds have a fixed capital structure and number of.

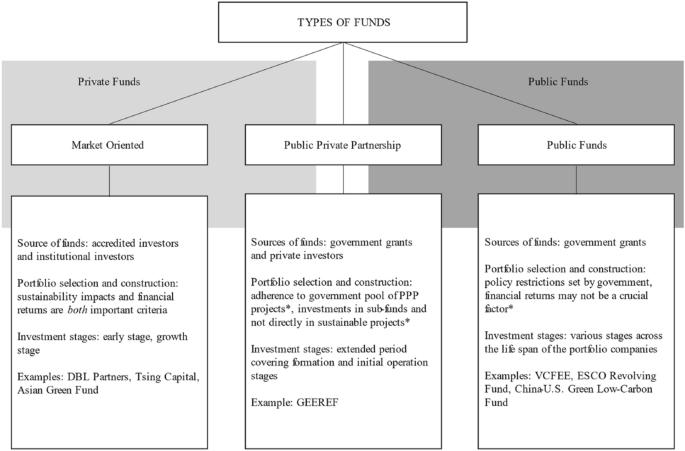

Venture Capital In The Rise Of Sustainable Investment Springerlink

Coronavirus Business Impact Evolving Perspective Mckinsey

Climate Change Credit Risk Management Deloitte Insights

Closed End Funds Investment Guide Blackrock

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Open Ended And Evergreen Funds In Venture Capital Toptal

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

Mutual Funds Different Types And How They Are Priced

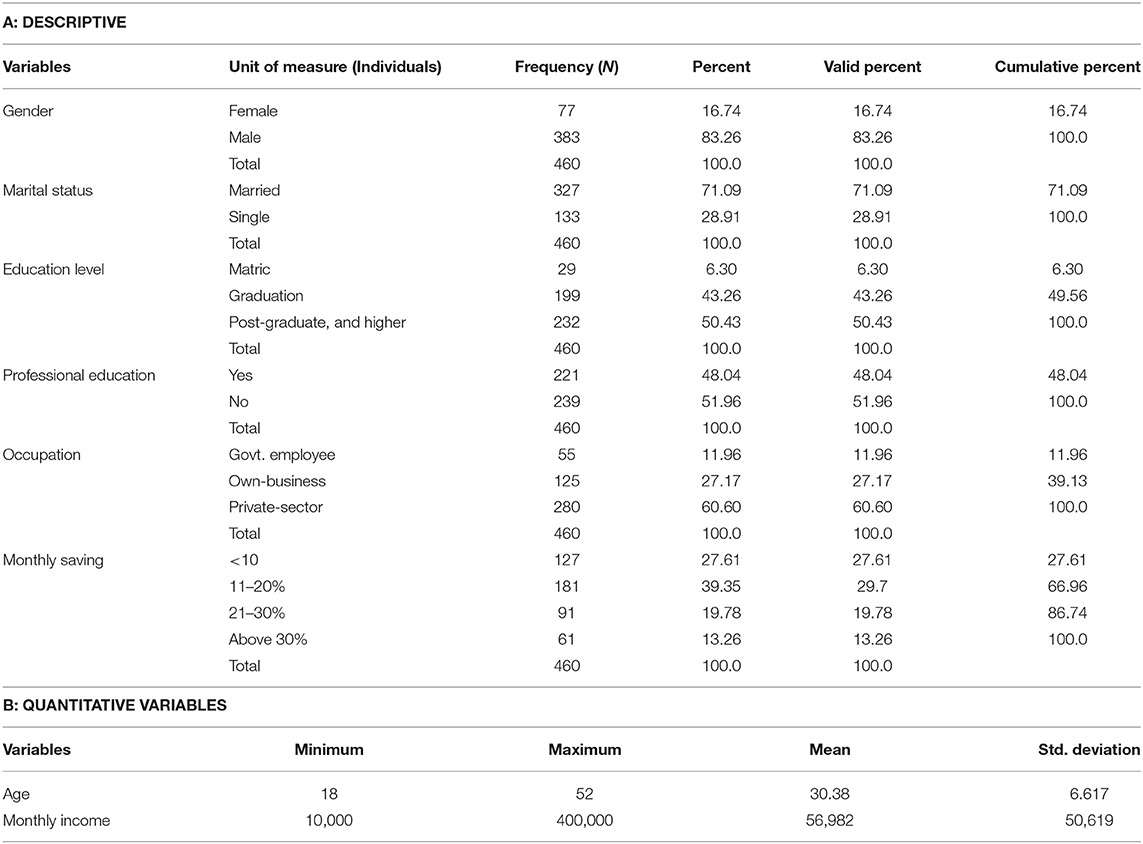

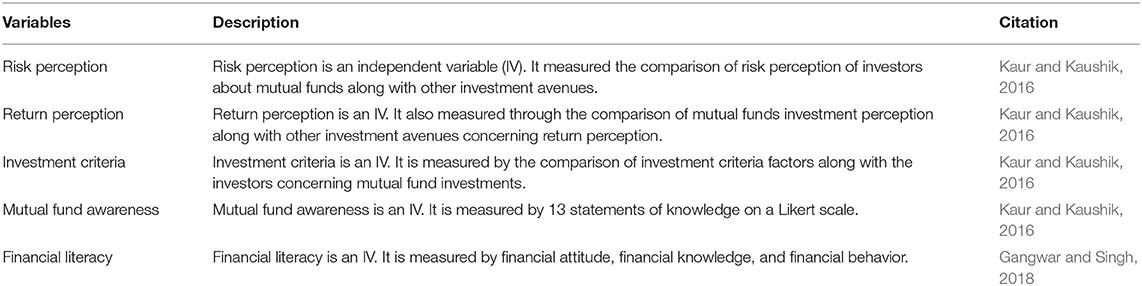

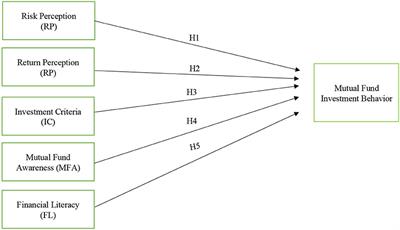

Frontiers Determinants Of Investment Behavior In Mutual Funds Evidence From Pakistan

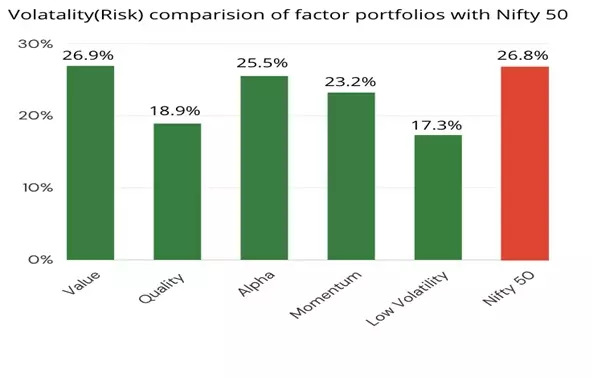

Investment Ideas Factor Investing 5 Ways In Which It Is Better Than Traditional Investing The Economic Times

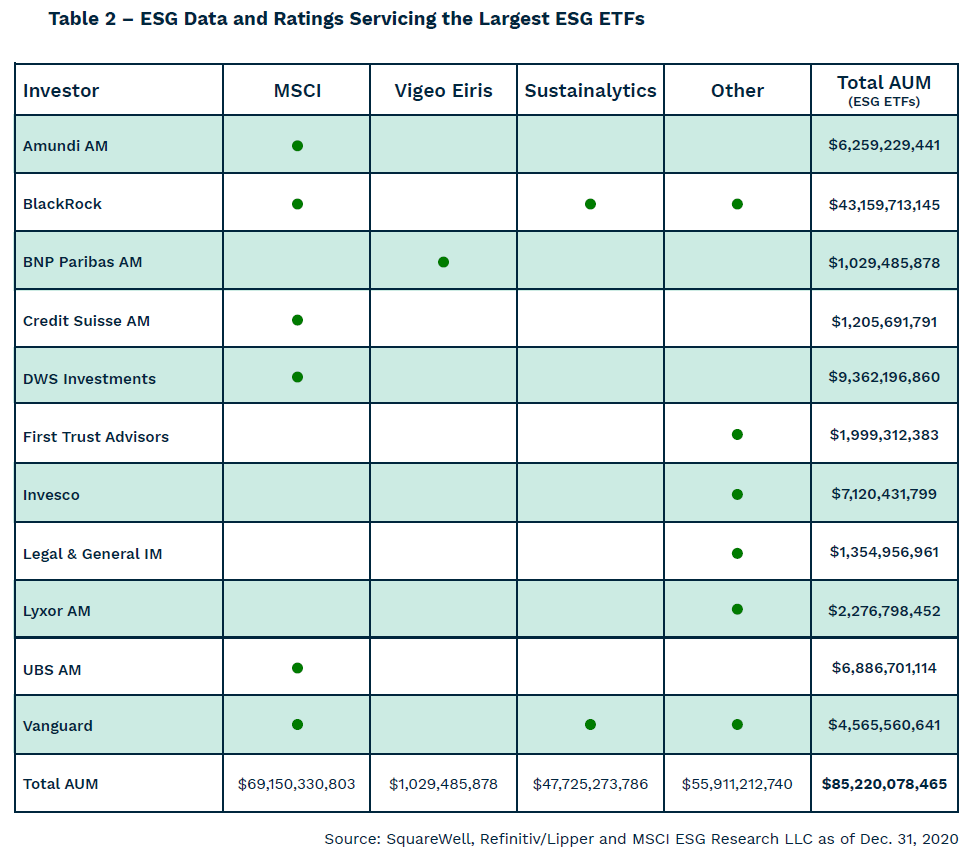

Managing Esg Data And Rating Risk

Frontiers Determinants Of Investment Behavior In Mutual Funds Evidence From Pakistan

Frontiers Determinants Of Investment Behavior In Mutual Funds Evidence From Pakistan

:max_bytes(150000):strip_icc()/Price-to-EarningsRatio_final-23bff9e93e624fdea7eb34ec993ea8a9.png)

:max_bytes(150000):strip_icc()/EPS-final-838bf0756ca04435ae9e15237ca914a7.png)

:max_bytes(150000):strip_icc()/mutualfund-final-253e20b35df7479b8afb203b56c934c2.png)

:max_bytes(150000):strip_icc()/mutual_funds_paper-5bfc2f4b46e0fb00260bd35d.jpg)

:max_bytes(150000):strip_icc()/roth-ira-v-mutual-funds-59cbcb8ad963ac0011ee1cec.jpg)